The second day of Congressional testimony on unsustainable drug prices brought into stark relief the strategies and tactics the pharmaceutical industry regularly relies on to price gouge patients and taxpayers to profiteer from expensive prescription medications.

A trio of pharmaceutical executives — representing drug makers Mallinckrodt, Amgen and Novartis — faced hours of questioning from members of the House Committee on Oversight and Reform, who pointed to real examples from internal company documents showing a coordinated orchestration of price increases using a variety of anticompetitive techniques. The companies’ motives were always the same: maximize revenue, pay high-dollar executive salaries, and deliver big returns to shareholders rather than investing in research and development.

In an emotional plea, one patient told the committee in a recorded video that, while the drug she takes has been lifesaving, the cost is frightening.

“Instead of just focusing on my family and my health, I also have to carry around the burden of what would happen if I couldn’t pay for it,” said Heidi Kendall of Montana, who has leukemia.

Instead of just focusing on my family and my health, I also have to carry around the burden of what would happen if I couldn’t pay for it.Heidi Kendall leukemia patient

We took a deep dive into the reports and tuned into the testimony. Here’s what we discovered:

Price Hikes Are Intentional to Drive Revenues

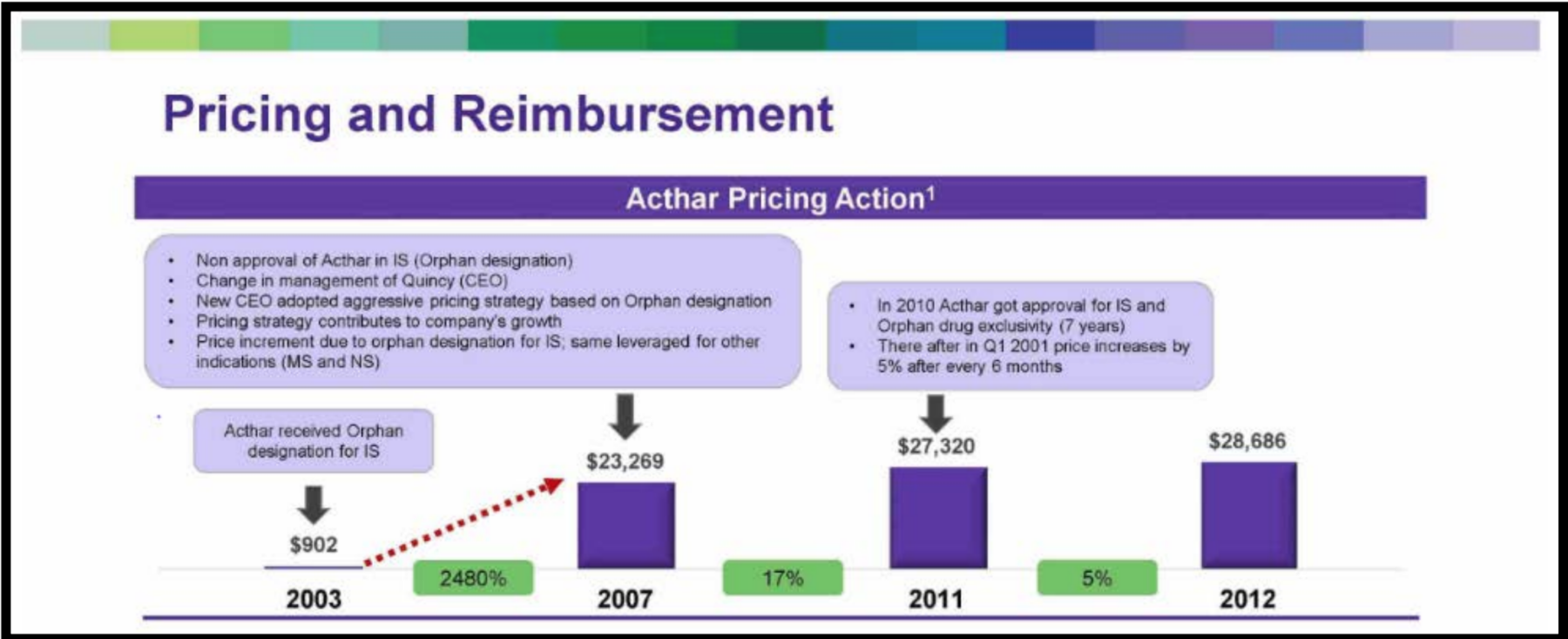

Mallinckrodt’s H.P. Acthar Gel — an inflammation drug — has come under fire for its exorbitant price in recent years despite it being approved by the U.S. Food and Drug Administration (FDA) in 1952. The price of the drug has increased from $40 a vial in 2001 to $39,000 in 2018. The drug’s price has increased an eye-popping 100,000 percent since Questcor first acquired the rights to the drug in 2001. As a result of its pricing decisions, Mallinckrodt has been sued repeatedly.

The impacts of the drug’s high price extend broadly. Internal company data shows that Mallinckrodt charged Medicare more for H.P. Acthar Gel than any other payer. Had Medicare been able to access the same discount as others payers — such as the U.S. Department of Veterans Affairs — taxpayers could have saved more than $656 million in just three years, according to the reports.

Mallinckrodt intentionally acquired Questcor for H.P. Acthar Gel because of its high price, describing the drug in one memo as a “cash cow.” The gel accounted for 50 percent of Mallinckrodt’s sales after the acquisition, and despite its already high price, Mallinckrodt’s hiked the price again after acquisition.

Internal documents showed that H.P. Acthar Gel’s orphan drug status — an FDA approval for drugs that treat rare diseases that affect fewer than 200,000 patients — allowed Mallinckrodt to “set a premium price.” Mallinckrodt then sought to drive revenue growth by expanding Acthar’s sales volumes for other indications.

Novartis’s Gleevec has been off-patent for years, but its annual price tag at $123,000 is equivalent to that of a luxury vehicle.

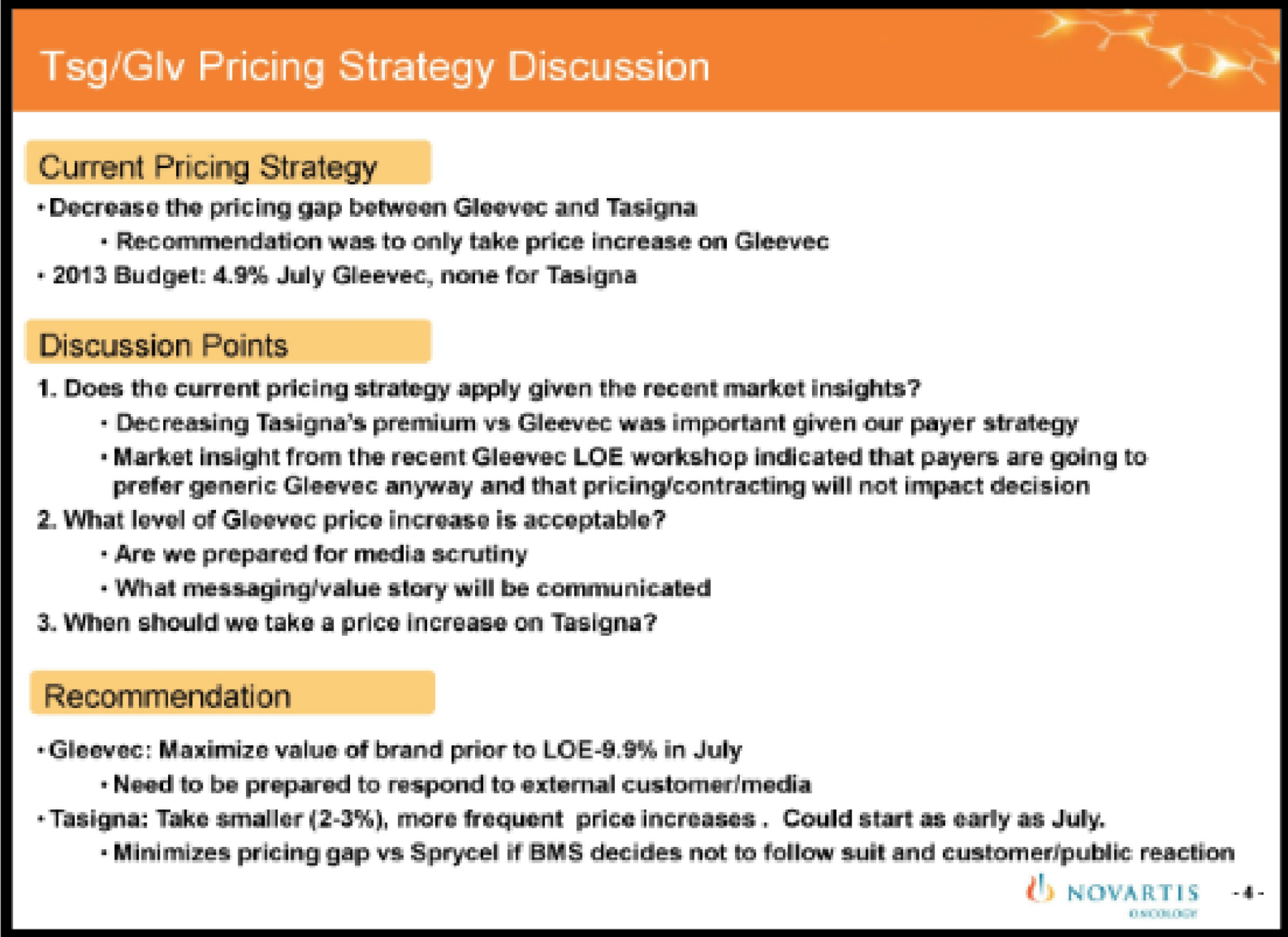

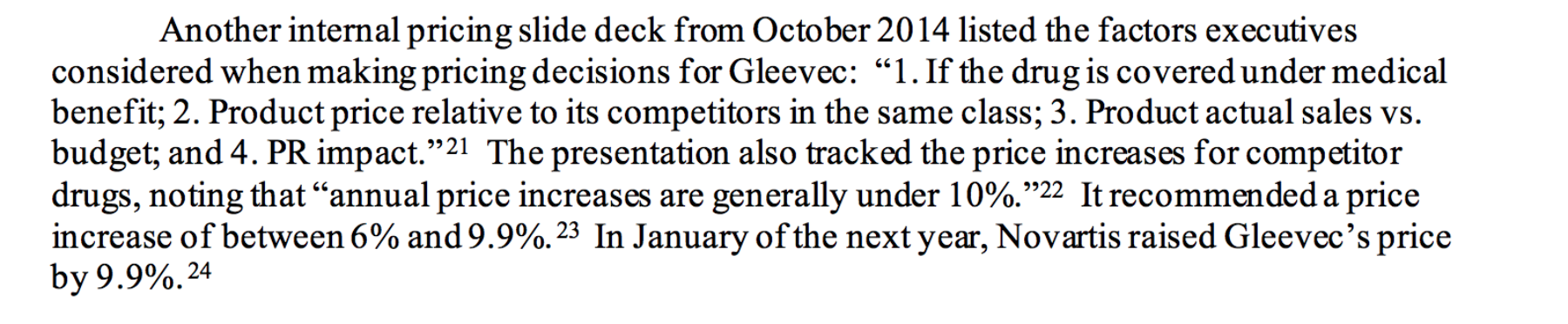

Novartis has raised the price of the cancer drug 22 times. Publicly, the company has said the high price tag is linked to the drug’s value, its cost, and the investment made into research and development, but internal memos obtained by the committee show that Novartis executives explicitly connected raising prices with meeting the company’s revenue goals.

Enbrel is one of the world’s most profitable drugs, netting $5 billion in U.S. revenue for Amgen in 2019 alone. The company’s net income has grown every year since it acquired Enbrel in 2002 and raised the price of the drug 27 times. A 50 milligram dose is now priced at $72,240 per year, a 457 percent increase from when Amgen acquired it.

Amgen is fully aware of the financial harm of its pricey drugs, with multiple complaints being filed by patients seeking help affording them, according to committee reports.

Anticompetitive Tactics Are Part of the Strategy

Patent games are key to the pharmaceutical industry’s strategy. Companies have long constructed “patent walls” to dominate the market, blocking competition and driving prices higher, and Thursday’s hearing provided more evidence of just how widespread this strategy has been used by pharma.

Even though the primary patent on Enbrel expired in 2010, Amgen has filed more than 50 additional patents on the drug to thwart price competition, according to an analysis by IMAK. This tactic has been effective — even though two biosimilars have been approved by the U.S. Food and Drug Administration, they ultimately aren’t on the market yet due to patent disputes.

Amgen has filed 68 patents for Enbrel, most that make marginal tweaks to the drug (for example, the drug’s delivery system); these patent applications have already prevented cheaper competition — which is available in other countries — from coming to the United States. If Amgen’s patents get approved, Enbrel’s monopoly would be extended to 2038, according to IMAK.

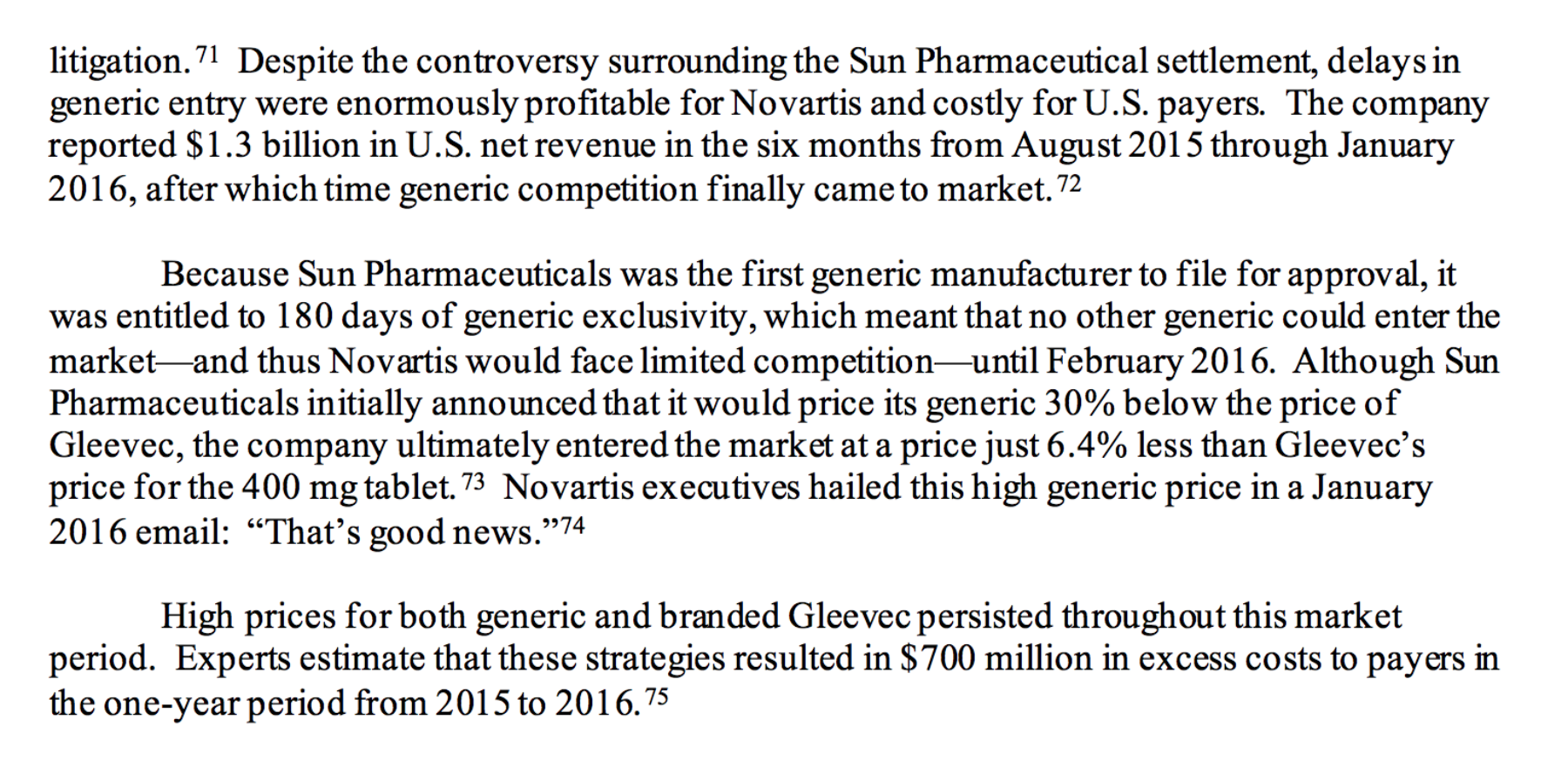

Novartis did everything it could to maintain its monopoly on Gleevec, deploying several anticompetitive tactics to delay generic competition and maintain profits, including engaging in a strategy called “pay for delay” — a pharmaceutical industry practice that involves brand-name drug makers compensating their generic counterparts for holding off on marketing their versions of brand-name drugs, causing longer delays in getting cheaper, generic drugs to the pharmacy counter. Novartis also sued at least five companies to block generic competition, leading to a class action lawsuit accusing the company of “shame litigation.”

This abuse of the legal system is estimated to have cost U.S. payers $700 million in a single year. When the company finally reached a settlement agreement with generic manufacturer Sun Pharmaceuticals that allowed Novartis to keep Gleevec’s price high by having the generic come to the market at a higher price than planned, a Novartis executive responded, “That’s good news.”

Moreover, the company devised a strategy to hike the price of Gleevec by at least 9.9% each year until it lost exclusivity for the drug, according to the committee report. In a “Demand the Brand” campaign aimed at providers and patients to block generic dispensing, Novartis disparaged generics and encouraged them to demand Gleevec to “Dispense-As-Written.”

It also used co-pay programs to drive demand for Gleevec and encouraged patients to stay on the brand-name drug after generics entered the market. Internal company memos show that Novartis expected its copay program would result in a $8.90 return on investment for every $1 invested.

In another example of anticompetitive behavior, Amgen failed to lower the price of Enbrel when its primary competitor, Humira, came to market as expected; instead, the company engaged in “shadow pricing” of Enbrel, increasing the price of the drug alongside the price of Humira, and putting it out of reach of many.

Pharma Increases Drug Prices in the U.S. Because It Can

Under questioning from Congress as to why other countries get deeper discounts than the U.S., the executives testifying Thursday struggled to come up with a response. Internal data obtained by the committee from Amgen shows that the company charges twice as much for Sensipar — a drug used to treat a condition in chronic kidney disease sufferers — than it charges in Canada.

The monthly price tag of Enbrel is $4,442 in the United States, versus $1,299 in Canada.

The wide differential in U.S. pricing versus other countries continues to harm patients like Kip Burgess of Chicago, who in a recorded video played Thursday expressed his gratitude for Amgen’s Enbrel, which allows him to remain symptom-free while he’s on the drug.

“But I also have to carry the fear knowing all this could be ripped away,” Burgess said.

Innovation Isn’t a Driver of High Prices

Contrary to arguments that research and development justifies high prices, Mallinckrodt has only invested $500 million into the drug since it acquired the drug. That’s less than 7 percent of the net revenue that Mallinckrodt received from the drug during the same period.

Meanwhile, Gleevec’s preclinical research and development costs were almost entirely (90 percent) paid for by taxpayers, via the National Cancer Institute, as well as nonprofit organizations.

Novartis’s own internal documents refute pharma’s argument that innovation drives high prices. In one memo, Novartis executives discussed the need to change the narrative around price increases, shifting their justification from “research and development” to the company’s investment in patient assistance programs — usually sponsored by the company to provide financial assistance to help patients access drugs for little or no cost. One internal company memo showed that patient assistance programs were a “crucial piece of Novartis’s strategy to mitigate its loss of exclusivity.”

When trying to decide a price point for Gleevec, Novartis executives had a list of considerations — coverage, product price relative to competitors, actual sales vs. budget and PR impact. Not listed in price considerations were research and development, the value of the drug to patients, and rebates.

Rebates Are a Red Herring

The six pharma executives who testified Wednesday and Thursday frequently attempted to blame rebates as a key factor for high drug prices, but internal company records published by the committee undermined that argument.

For example, list prices for Enbrel outpaced the rebates that Amgen paid, according to the committee’s reports. These price increased allowed Amgen to maintain high net revenue, despite declines in Enbrel sales volume and increases in rebates.

“The Committee’s work — both in the reports and the hearings — demonstrated what we have been saying,” said Kristi Martin, Vice President of Drug Pricing at Arnold Ventures. “Pharma puts profits over patients, and now we have the internal documents that demonstrate their true intentions. We are looking forward to what else the Committee will be presenting to finish out their investigations in the coming months.”

Trump’s Executive Orders, Explained

Details of Trump’s actions on drug prices reveal little impact on patients, employers, or taxpayers.

Read more