Arnold Ventures recently responded to a request for information on design considerations for a public health insurance option issued by Sen. Patty Murray, Chairwoman of the Senate Health, Education, Labor, and Pensions committee, and Rep. Frank Pallone, Chairman of the House Energy and Commerce committee. The Chairs state that in addition to expanding coverage, one of their goals is developing a public option that lowers health care costs.

We share this commitment to lowering health care costs, and thank the committees for their focus on this important issue. Recent polling shows that health care affordability remains a top priority for Americans, regardless of their political affiliation.

Containing health care costs will require addressing the key cost driver — the excessive prices dominant providers often charge the privately insured. Prices charged to patients are often set arbitrarily and are irrationally high, on average exceeding the cost of providing care by 50%. For example, in Memphis, Tennessee you can be charged less than $57 or upwards of $597 for the exact same blood test, depending on the lab you visit. Research shows some hospitals charge non-Medicare patients nearly 2.5 times more than patients with Medicare for the same service.

The reason? An increasingly consolidated and uncompetitive hospital market. When large hospital systems and Wall Street private equity firms buy up and consolidate smaller hospitals and physician practices, they increase their market power, stifle competition, and increase their prices.

High and rising prices have led to higher premiums, higher deductibles and cost-sharing, access issues, and lower wages. A recent study found that unpaid medical bills now make up the largest source of debt that Americans owe to collections agencies. Beyond these impacts on consumers, high health care prices are also an increasing burden for employers and the federal budget. Americans are feeling these effects and demanding action. An astonishing 90% of voters say it is important for this Congress to take action that will reduce health care prices.

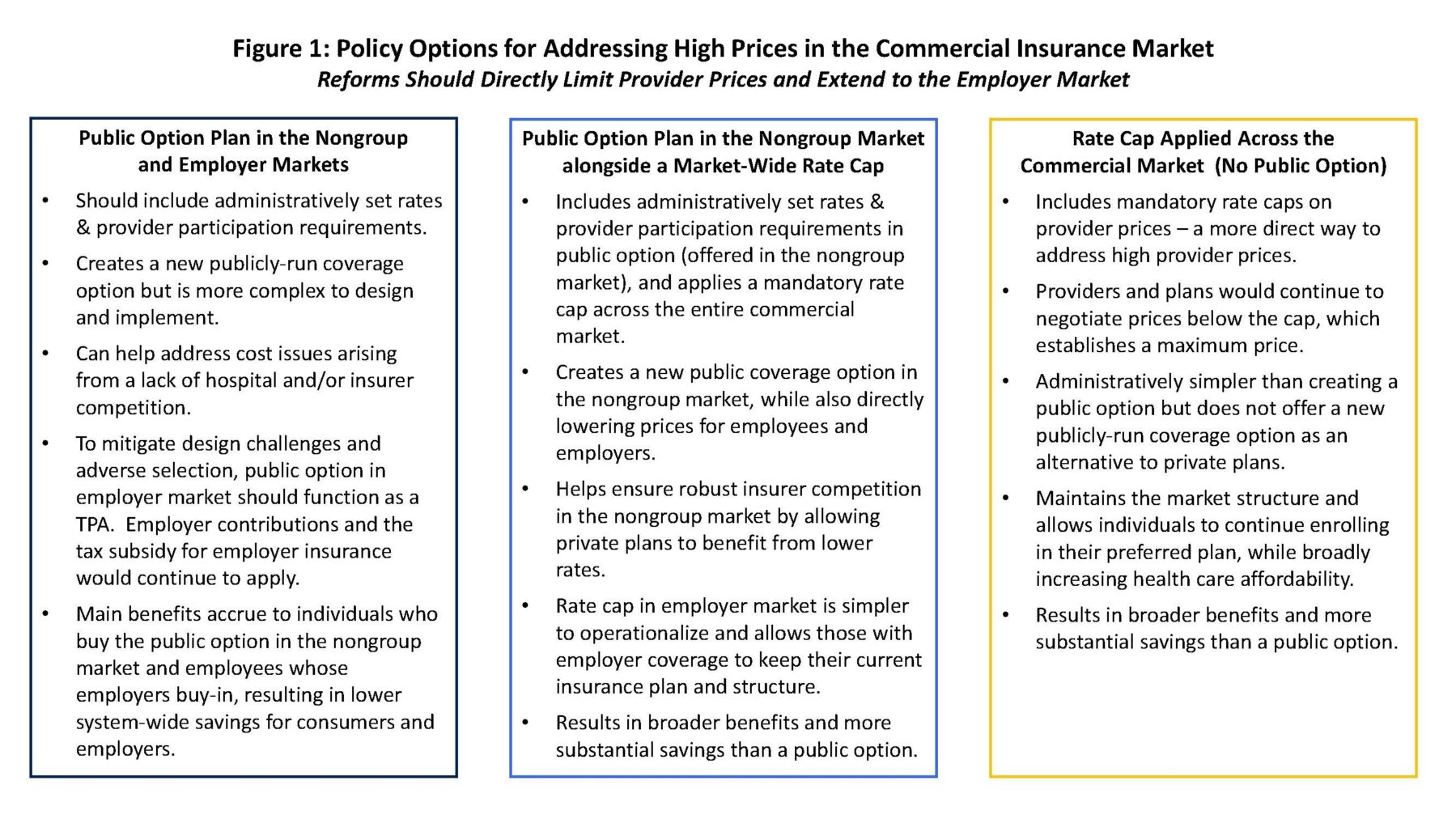

A well-designed public option that limits what providers can charge is one way to create more affordable coverage options. But it’s not the only way. Policymakers could alternatively pursue other policies to address high health care prices such as capping provider payment rates, which would limit the maximum price providers can charge. Both options would improve affordability and lower health care costs for consumers, businesses, and the federal government if they are well-designed with appropriate limits on provider reimbursement rates — though each has its own advantages and disadvantages.

Arnold Ventures’ response to the committee’s outlines design choices and considerations that should be taken into account when developing either policy option, and explores the relative merits of each. Several principles guide our recommendations:

- The primary goal of any reform should be containing costs and making coverage more affordable. Reforms that do not lower costs will likely have little effect on spending and coverage.

- To effectively lower costs and result in savings for consumers, employers, and the government, policymakers must limit the prices hospitals and physicians can charge the privately insured and include a strong enforcement mechanism. For example, a public option should combine administratively set rates with a provider participation requirement to ensure an adequate provider network at the lower rates.

- Reforms to lower provider prices should be extended throughout the private insurance market, including to people with employer-sponsored insurance. Excessive prices and affordability challenges exist across the entire private market. The employer market also covers many more people than the individual market. Extending reforms to the employer market generates larger effects on spending and coverage. It would have higher potential benefits for consumers and employers, as well as a larger positive impact on the federal deficit.