Capping Business SALT

As the Tax Cuts and Jobs Act (TCJA) provisions approach their 2025 expiration date, policymakers face a significant fiscal challenge: extending these tax cuts would add approximately $4.5 trillion to the federal deficit over the next decade. Finding responsible offsets to minimize this massive deficit impact has become a critical policy priority. One promising approach is capping the state and local tax (SALT) deduction for businesses — known as Business SALT.

Arnold Ventures’ Recommendation:

Apply the existing $10,000 SALT cap to businesses to help level the playing field across business types, reduce distortions in the tax code, and raise over $430 billion in revenue over 10 years.

This policy recommendation would:

- Generate Significant Revenue of approximately $100 billion over 10 years that could help reduce the $4.5 trillion deficit impact of extending the TCJA

- Eliminate the Incentive for business owners to convert to C corporation status purely for tax avoidance purposes, which has increased since the implementation of the individual SALT cap in 2017

- Level the Playing Field between businesses and individuals by eliminating the inequity where individuals face a $10,000 cap while businesses enjoy unlimited deductions

Background

See all

A Pro-Growth Approach to Capping the SALT Deduction for Businesses

Federal Tax Policy

A Pro-Growth Approach to Capping the SALT Deduction for Businesses

Capping C-SALT Is a Smart, Fiscally Responsible Tradeoff

Federal Tax Policy

Capping C‑SALT Is a Smart, Fiscally Responsible Tradeoff

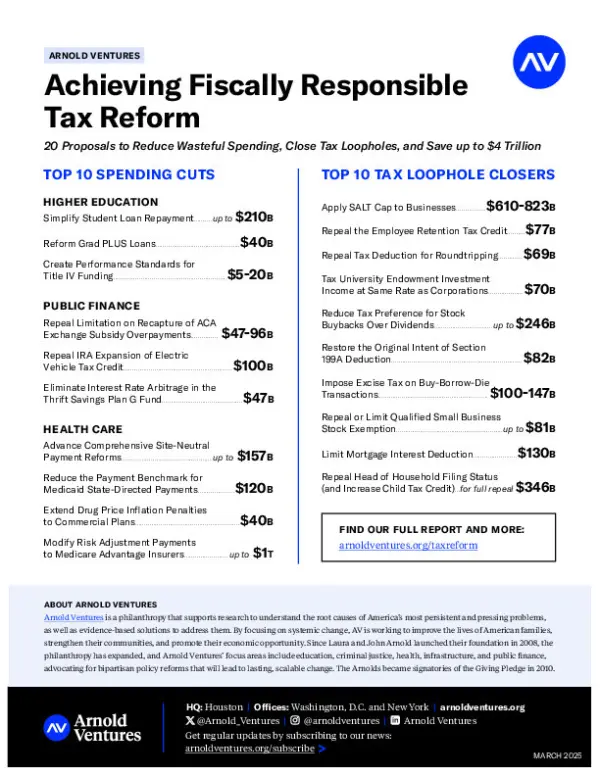

AV Proposals for Achieving Fiscally Responsible Tax Reform

Federal Tax Policy

AV Proposals for Achieving Fiscally Responsible Tax Reform

No Baseline Can Fix a Broken Budget

Federal Tax Policy

No Baseline Can Fix a Broken Budget