In the minutes before it convened a testimony featuring three top pharmaceutical company executives, the House Committee on Oversight and Reform released two bombshell reports exposing how drug companies have systematically used a strategy of high launch prices, regular price increases and anticompetitive tactics to generate higher revenues, bigger executive bonuses and block generics for decades.

The two reports examined how the companies behind a pair of drugs with high list prices — multiple sclerosis drug Copaxone and cancer drug Revlimid — orchestrated price hikes to turn higher profits, often at the expense of countless patients who are unable to afford the drugs.

Relying on a trove of internal documents to expose bad behaviors at Teva, Bristol Myers Squibb and Celgene, the reports paint a portrait of pharma’s thought process and actions regarding high drug prices.

We read the reports and listened to testimony from the CEOs. Here’s what we learned.

Price Hikes Are Intentional to Drive Revenues

Since its launch in 2005, the price of Revlimid has increased 22 times, ballooning from $215 per pill to $719 per pill, according to the House Oversight Committee’s report. Bristol Myers Squibb acquired the drug in November 2019 and hiked the price again – bringing the price tag for a monthly course of the drug to $16,023.

These price hikes cause real financial harm to people like Ramae Hamrin of Minnesota, who testified in a recorded video that, in order to afford Revlimid, she will “have to deplete her life savings, cash out her 401k and sell her house.”

Copaxone is equally unaffordable. Teva increased the price of Copaxone 27 times since launching it in 1997. Due to these price increases, a yearly course of Copaxone costs seven times more today than it did at lauch.

Even Teva’s own employees could not afford Copaxone, according to the report. One worker said she could no longer afford to pay $1,673.33 out of pocket for Copaxone versus $12 for Mylan’s generic product, according to internal company communications cited by the committee.

Pharma Increases Drug Prices in the U.S. Because It Can

Internal documents and TEVA’s CEO’s testimony show that the company took advantage of the lack of any governmental interventions. Teva targeted the U.S. market for price increases on Copaxone while maintaining or cutting prices for the rest of the world.

In fact, internal Teva documents warned that the legislative reform that posed the greatest threat to Teva’s future revenue was “Medicare Reform: Removal of government non-interference”, the report states.

Teva exploited Medicare’s inability to negotiate, the fact that the U.S. has no limits to what companies can charge and does not link prices to clinical benefits like other countries. As a result, Medicare has spent hundreds of millions of dollars more on Copaxone than it would have had it had access to the same discounted price offered to other federal programs, such as the U.S. Department of Veteran Affairs, which do have the ability to negotiate.

Perhaps more telling, Teva’s CEO testified to Congress that the company is still able to turn a profit in countries that do have the ability to negotiate discounted prices.

Innovation Isn’t a Driver of High Prices

Big Pharma has long justified its higher prices by pointing to its investments in research and development, but the reports and testimony Wednesday revealed that drug companies spend millions of dollars on defending patents, obtaining more patents and engaging in anticompetitive behaviors to thwart competition and maintain a stranglehold over the market.

Between 2005 and 2015, about 75 percent of new patents were for existing drugs on the market.

Celgene has relied heavily on taxpayer-funded academic research to develop the drug.

Moreover, internal documents from Celgene indicated that the high price of Revlimid was leveraged to undermine other companies’ R&D efforts. One executive wrote, “Making [another company] spend a lot more on their trials puts financial constraints on their ability to simultaneously fund lots of trials.” Another executive agreed, writing, “Anything we can do to hamper their development would help.”

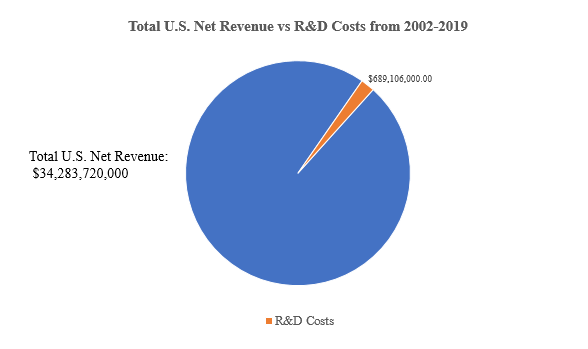

Contrary to its public talking points, Teva invested only a small portion of its Copaxone revenue in further research and development to help Copaxone patients. Teva made $34 billion in net U.S. revenue on Copaxone, but spent an amount equal to just 2 percent of that on research and development on the drug, according to the report. Not a single R&D expenditure after 2015 is reported by Teva for Copaxone, but the price continued to increase.

Analysts at IMAK found that the U.S. patent system no longer promotes innovation for drugs; it protects monopolies.

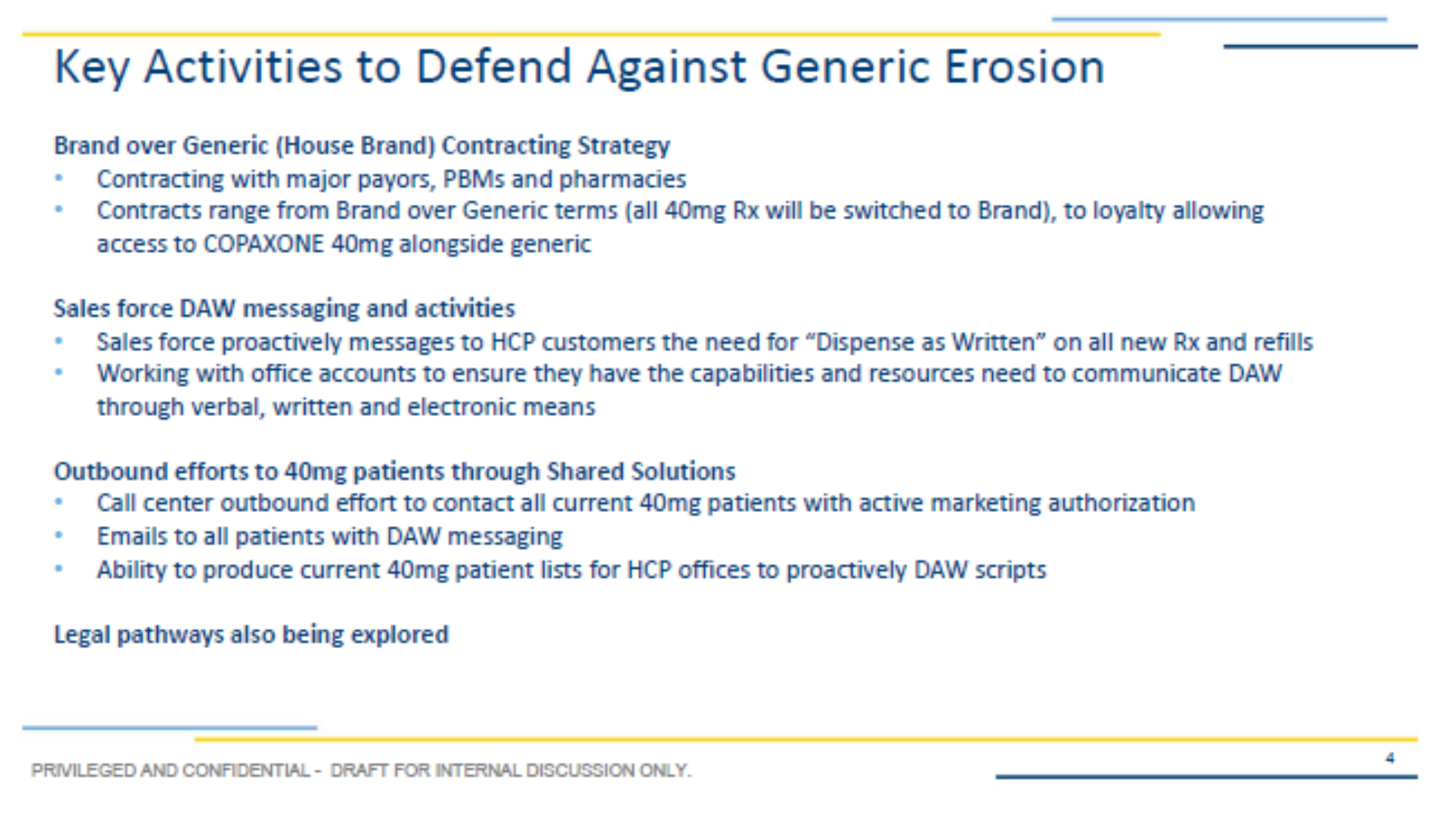

In manipulating the patent system, Teva was able to avoid paying millions in statutory Medicaid rebates by switching patients from Copaxone 20 mg/ml to Copaxone 40 mg/ml. Teva’s strategy of shifting patients from Copaxone 20 mg/ml to Copaxone 40 mg/ml prior to generic entry created a 2.5 year delay in generic completion and cost the U.S. health care system between $4.3 and $6.5 billion in excess expenditures.

Rebates Are a Red Herring

Another long-standing pharmaceutical industry talking point is that prices are high because of the use of rebates in the U.S. system; however, the report and testimony revealed that Celgene provided no discounts to Medicare Part D plans, and the largest discount it paid in the commercial market was only 5 percent.

Celgene’s own internal documents undermine pharma’s claims that price increases are the result of increased rebates, discounts & other fees provided to PBMs.

Teva blocked generic competition by manipulating the rebate system. Teva tied contractual rebates with PBMs on Copaxone 20 mg/ml to adding Copaxone 40 mg/ml to their formularies. Despite an announcement in 2008 that a clinical trial had found no difference in efficacy between the two doses of Copaxone.

Price Increases Feed Corporate Profits

As patients like Ramae Hamrin are forced to make difficult choices about their financial situations, Celgene reported more than $51 billion in net worldwide revenue from 2009 to 2018 from Revlimid, with the U.S. market accounting for $32 billion of that total.

The committee found that Celgene executives made decisions about pricing “almost exclusively … to meet company revenue targets and shareholder earnings goals”, citing an example in which a former CEO “orchestrated an emergency price increase for Revlimid in 2014 to ensure that Celgene met its quarterly revenue targets.”

Teva’s CEO testified that Copaxone’s high price is justified because of its value to patients, but the Institute for Clinical and Economic Review has found that a fair price for Copaxone is closer to 67% to 85% percent less than its retail price.

Additionally, the CEOs testified that their patient assistance programs are altruistic efforts by the companies to help patients who can’t afford their drugs. In fact, patient assistance programs and coupons have been identified as an effort by drug companies to maintain monopolies and increase revenue.

Anticompetitive Tactics Are Part of the Strategy

The House Oversight report revealed that Celgene suppressed competition by abusing a government-mandated safety program (REMS) and excluding competition by leveraging the U.S. patent system, which Celgene described internally as being “far more protective of its monopoly pricing than patent systems in the rest of the world.”

Revlimid should have been subject to competition from generic drug makers starting in 2009, bringing down its cost by many orders of magnitude, but by obtaining 27 additional patents, 8 orphan drug exclusivities and 91 total additional protections from the FDA, Revlimid has blocked competition through at least 2028.

This is a textbook example of evergreening, a tactic by Big Pharma to sustain a monopoly by manipulating patent law. Among the 100 best-selling drugs, more than 70% have extended their protection from competition at least once.

Evergreening is becoming more common. The pharmaceutical industry is largely recycling and repurposing old drugs. Once companies extend protection with more patents on existing products, they return to the well, with the majority adding more than one extension and 50 percent becoming serial offenders.

Like Celgene, Teva also relied on exclusionary tactics to limit generic competition and maintain profits, contracting with specialty pharmacies and pharmacy benefit managers (PBMs) to limit generic substitution, lobbying doctors to write prescriptions for Copaxone that prohibited generic substitution, and using its patient programs to convince patients to remain on the more expensive brand name version, according to the House Oversight Committee findings.

This tactic of blocking generic drugs from coming to market is a frequent — and costly — strategy used by pharma. Nearly half of brand-name drugs studied by Dr. Aaron Kesselheim and colleagues saw delayed generic competition or none at all.

Executive Bonuses Are Tied to Price Increases

Celgene’s top executives earned higher bonuses in 2016 and 2017, internal company documents show, because of Revlimlid’s price increases.

At Teva, top executives were paid more than $190 million between 2012 and 2017, the peak years for U.S. Copaxone revenue.

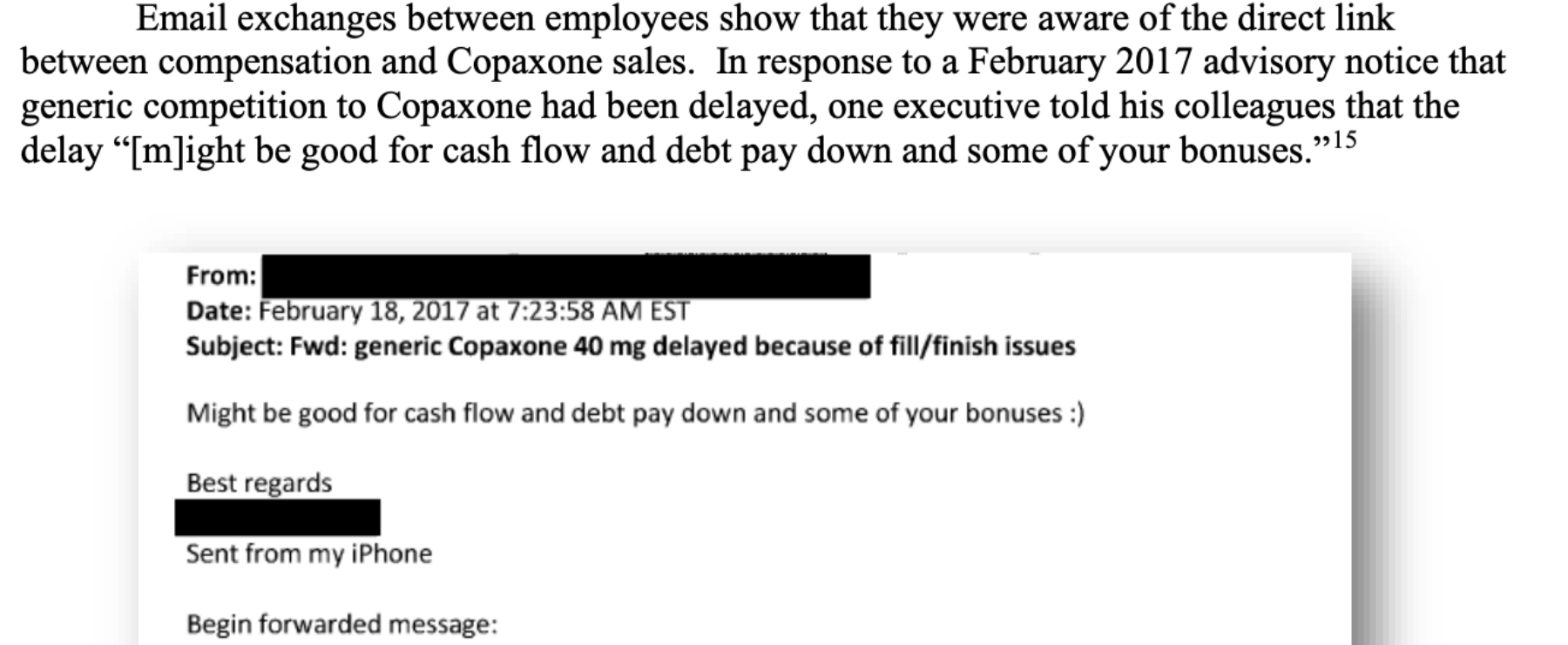

Even lower level employees were aware of the direct link between their compensation and Copaxone’s price and revenue. One executive told his colleagues that the delay in generic competition “[m]ight be good for cash flow and debt pay down and some of your bonuses.”

The committee convenes tomorrow for another round of testimony from pharma CEOs. Follow along on Twitter with @Arnold_Ventures for live analysis.

Background reading:

- I‑MAK | America’s Overspend: How the Pharmaceutical Patent Problem is Fueling High Drug Prices

- I‑MAK | Overpatented, Overpriced

- Stacie Dusetzina | Sending The Wrong Price Signal: Why Do Some Brand-Name Drugs Cost Medicare Beneficiaries Less Than Generics?

- 46Brooklyn | The Flawed Design of Medicare Part D: A Copaxone Case Study

- PORTAL | US Spending Associated With Transition From Daily to 3‑Times-Weekly Glatiramer Acetate

Trump’s Executive Orders, Explained

Details of Trump’s actions on drug prices reveal little impact on patients, employers, or taxpayers.

Read more